People search

This member of our team has left

Enter the first letters of someone's name or surname

Elaine Aarons

PARTNER | London

Julia Abrey

CONSULTANT | London

Rosan L. Agbajoh

ASSOCIATE | San Francisco

Chloé Agelou

ASSOCIATE | New York

Pervaze Ahmed

PARTNER | London

Farahna Alam

ASSOCIATE | Singapore

Jan Alessandrini

ASSOCIATE | British Virgin Islands

Sarfraz Ali

SENIOR ASSOCIATE | London

Sholihin Amin

ASSOCIATE | Singapore

Sergio Anania

PARTNER | Milan

Roy Ang

EXECUTIVE DIRECTOR AND HEAD OF BUSINESS DEVELOPMENT AND MARKETING (APAC) | Singapore

Roy Ang

EXECUTIVE DIRECTOR AND HEAD OF BUSINESS DEVELOPMENT AND MARKETING (APAC) | Singapore

Marketing, BD and communications

View Profile

Ryan Ang

ASSOCIATE | Singapore

Azlinda Ariffin-Boromand

CONSULTING PARTNER | London

Lana Armstrong

ASSOCIATE | London

Sarah Arnold

HUMAN RESOURCES MANAGER | Geneva

Hallie Aronson

ASSOCIATE | New Haven

Eleanor Ashby

ASSOCIATE | London

Emma Ashe O'Toole

ASSOCIATE | New York

Kaitlyn Auddino

OPERATIONS & ADMINISTRATIVE SUPPORT MANAGER | New Haven

Kaitlyn Auddino

OPERATIONS & ADMINISTRATIVE SUPPORT MANAGER | New Haven

Human resources

View Profile

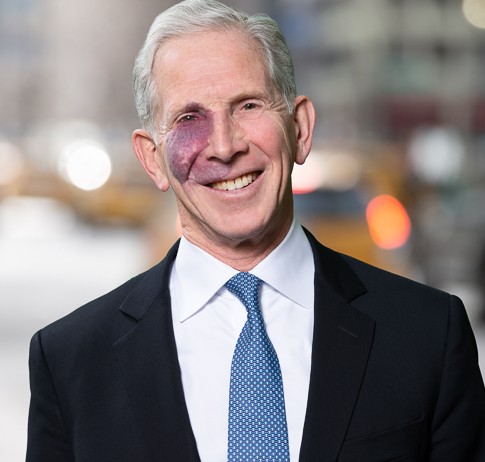

Martin J. Auerbach

OF COUNSEL | New York

Sarah Aughwane

PARTNER | London

Andrea Auriemma

TRAINEE | Milan

Elia Baggio

ASSOCIATE | Padua

Albie Bairamian

TRAINEE SOLICITOR | London