> Experience > Areas of focus > Crypto and digital assets

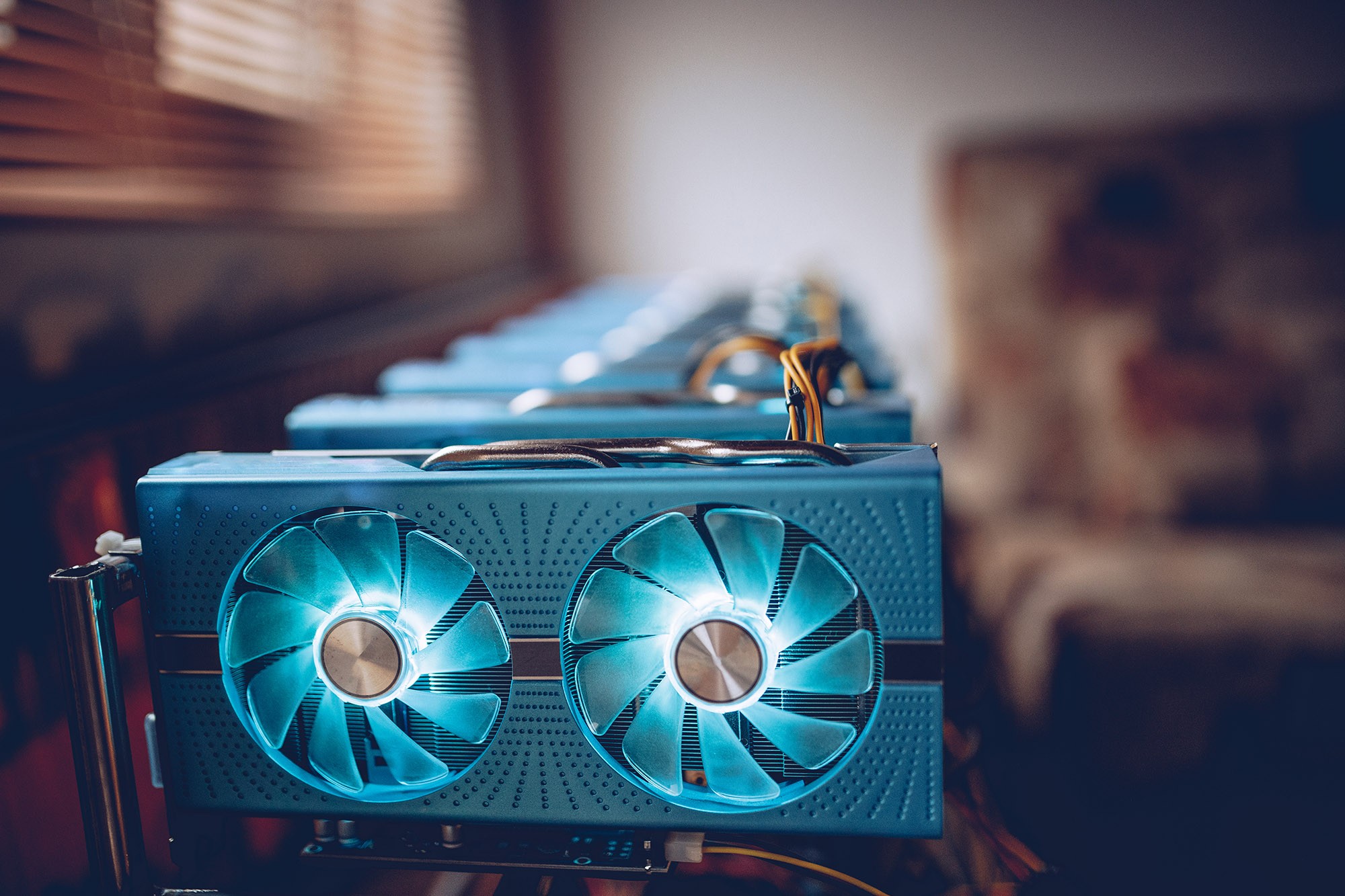

暗号資産とデジタル資産

当事務所は、個人や企業がブロックチェーン、仮想通貨及び分散型金融のエコシステムをうまく進めるよう支援します。

仮想通貨、ステーブルコイン、分散化取引所及びウォレットから支払ネットワーク、貸付及び保険プラットフォーム、主要インフラ開発、マーケットプレイス及び投資エンジンまで、分散型金融(「DeFi」)のエコシステムは、グローバル金融の新しくエキサイティングな時代の到来を告げています。

市場洞察力

当事務所は、法律的にも技術的にも、DeFiを理解しています。私たちは、この分野におけるイノベーションの基盤となる技術を把握し、開発さえしてきました。私たちは、仮想通貨、コンセンサスベースのアルゴリズム、スマートコントラクトを、クライアントのために定期的に扱っています。また、当事務所のグローバルチームは、人工知能、モノのインターネット(「IoT」)センサー、スマートコントラクトを活用したパンデミック主導の次世代サプライチェーンエコシステムの法的要件及びコンプライアンス要件をすべて理解し、対応することができます。これらの相互運用可能なエコシステムが一体となって、次世代のグローバル経済の基盤となるのです。

フィンテック関連紛争及び規制業務

当事務所のチームは、仮想通貨及びフィンテック分野において規制、訴訟及び仲裁サービスを提供しています。当事務所は、成長を続けるこの分野や隣接分野で活動する個人及び企業に適用される既存及び変わりつつある規制枠組に関し経験を有し、世界中の民事訴訟及び仲裁並びに米国証券取引委員会(「SEC」)、米国商品先物取引委員会(「CFTC」)、米国内国歳入庁(「IRS」)、シンガポール通貨庁、英国金融行動監視機構(「FCA」)等、さまざまな裁判所、検察官、規制当局及びび機関において、個人及び法人を代理します。.

仲間になりましょう

他にも皆様に有益なニュースや情報をたくさんご用意しています。ご関心のある分野をお知らせいただければ、お客様にとって重要な問題について、常に最新の情報をお届けします。

私たちのチーム

Eric N. Roose エリック・ルース

パートナー | 東京

連絡する

当事務所のウェブサイトでは、私たちが提供するアドバイスの一部をご紹介しています。より詳細な情報をご希望の方は、当社のクライアント・サービス・チームにご連絡ください。