With assets under management worth over USD 10 trillion(1) and about 7.8% of all listed equities worldwide(2) under their control, Sovereign Wealth Funds ('SWFs') are among the world’s most powerful economic actors. The 20 largest SWFs own 89% of these assets(3). Despite their significance, the topic of SWFs and dispute resolution has not until now received the comprehensive consideration and analysis that its importance merits.

This joint report, co-authored* by Withers' public international law team and the British Institute of International Comparative Law, focuses on the transnational dimension of SWFs. It reviews different approaches to defining SWFs, their origins and cross-border operations.

The report explores transnational dispute resolution involving SWFs before both national courts and international courts and tribunals (including investment treaty and commercial arbitrations) and discusses strategic legal issues such as the fora in which disputes involving SWFs are settled, the subject matter of disputes involving SWFs and a host of related jurisdictional and merits issues.

The Report further considers regulatory and other issues related to the position of SWFs in a changing world, with sections dealing with questions related to the screening of SWF investments, sanctions affecting the operations of SWFs and the impact of business and human rights on SWF’s operations. It also brings together institutional definitions of SWFs, lists the largest SWFs and examines their corporate structures. Finally, it provides detailed summaries of cases involving SWFs from key jurisdictions.

To read the report in full, please click here.

*The authors would like to thank the following lawyers from Withers for their invaluable assistance in preparing the Report: Dr Aniruddha Rajput, Ms Jovana Crnevic, Ms Clàudia Baró Huelmo, Ms Christina Liew, Mr Giacomo Gasparotti, Ms Martha Male and Ms Yousra Salem. The authors would also like to thank everyone who kindly reviewed drafts of the Report and provided feedback including in particular: Mr Diego Lopez, Dr Claudia Annacker and Dr Dini Sejko. A special thanks goes to Mr Diego Lopez and Global SWF also for supplying up-to-date and unpublished data and graphs on SWFs and their investment activities that are incorporated into this Report.

Insight from the report

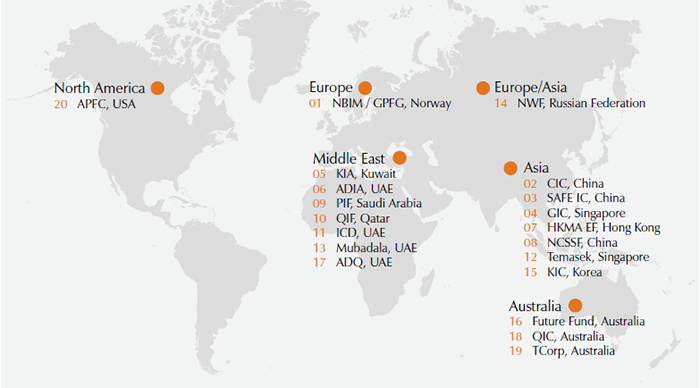

SWFs are located worldwide. The 20 largest SWFs (as at 22 August 2021) are spread across the Middle East, Asia, Europe, North America and Australia.

Although SWFs’ investment geography is varied, it is notable that between 2015 and 2021 SWFs have invested predominantly in emerging markets(4). In 2020, SWFs investments in emerging markets amounted to 66% of SWFs’ investment by region(5). By 2021, the trend decreased, but emerging markets still represent almost 49% of SWFs target regions to invest in(6).

The importance of SWFs in the global economy has grown in the years following the financial crisis of 2008, and ‘with many governments assuming … the role of guardians of substantial amounts of their countries’ financial assets, effective wealth management has become an important public sector responsibility’(7). The value of SWFs amplifies their impact on the world economy.

Since 2000, over 100 new SWFs have emerged. Data collected and analysed by Global SWF also shows that assets management under SWFs grew by 212% between 2008 and 2021.

SWFs engage in major cross-border acquisitions and corporate transactions in economic sectors such as real estate, infrastructure, TMT and healthcare. Disputes involving SWFs may include proceedings before national courts, commercial arbitrations, investment treaty arbitrations, and, to some extent, State-to-State disputes before international courts and tribunals.

State-to-State dispute resolution is a potentially underestimated avenue for a SWF to bring a claim against the host State of its investment.

Responsible business conduct and human rights responsibilities are particularly important for institutional investors such as SWFs.

SWFs by their nature act as long-term investors ‘...with the aim of leaving a legacy and safeguarding national wealth for future generations’, and may therefore be expected to direct their investment policy towards more responsible firms which adopt policies aimed at sustainability(8).