Season's Greetings

A message from our Chair, Paul Hewitt.

We wish you a peaceful festive season, and a Happy New Year.

Recent insight

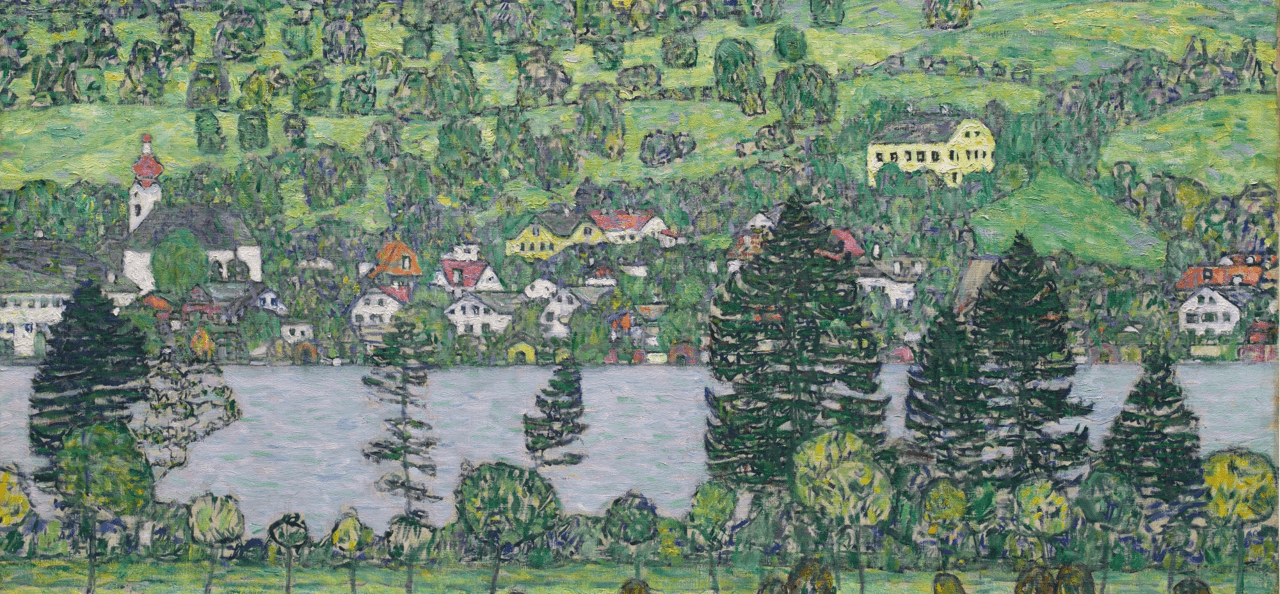

Withers Art and Advisory

The Fiduciary Eye

The Fiduciary Eye is our seasonal newsletter providing data-driven insight about the art market written from a fiduciary's perspective.

LEARN MOREFind a professional

The key to our success lies in the skill and experience of our people. With 220+ partners, over 650 lawyers and around 1,500 staff globally, our team is brimming with creativity, personality and legal knowledge.

HOT TOPIC

Backing innovation

Where private capital and powerful ideas meet

Whether you are an investor, founder, business leader or philanthropic foundation, our role is to help you realize your ambitions and shape your long-term strategy.

We'll provide commercial and robust legal advice at every step.

In your corner, when it really counts

Resolving crypto, business and family disputes globally. We are with you when you need us most.

International dispute resolution

HOT TOPIC

Italy: a smart move

For you, your family and your business.

Relocating to Italy has never been more appealing – favorable tax and immigration incentives, a thriving business landscape, and an unmatched quality of life. Discover why now is the perfect time to make Italy your home.

FIND OUT MORE

A career at Withers

Join an ambitious, collaborative international law firm where individuals are valued, and voices are heard. A truly flexible working culture that puts people first.

We don’t shy away from challenging questions or new ideas.

If that sounds like you, we should talk.