Insight > The Fiduciary Eye | New York art market report - November 2025

The Fiduciary Eye | New York art market report - November 2025

Welcome to the inaugural edition of The Fiduciary Eye, a seasonal newsletter providing data-driven insight about the art market written from a fiduciary’s perspective.

It comes to you from 'Withers Art and Advisory', a unique practice that integrates top-tier legal experience with insider know-how from the commercial art market.

IN THIS ISSUE: WELCOME | MARKET OVERVIEW | SALES HIGHLIGHTS | AUCTION HOUSE TOTALS | KEY FIDUCIARY ISSUES

In writing The Fiduciary Eye, we will call upon our deep well of experience in law and business to surface critical commercial and legal issues of interest to collectors and their fiduciaries, while revealing the hidden dynamics that power the highest reaches of the art market. In this issue, we review results from the biggest New York auction week in three years and take a deep dive into some of the key issues these sales raise for fiduciaries, including blockage, guarantees, and marketing strategy; we then discuss considerations for selling in this newly energized market.

A new chapter of innovation within a storied law firm

Training in art history or the art market is not required to become an 'art lawyer'. At 'Withers Art and Advisory', we know that our clients need more. In the complex global art market, where art collections are stores of great wealth and billions of dollars in property is traded at auction and privately, simply mastering the law is not sufficient.

'Our goal is to provide commercially minded, pragmatic counsel grounded in legal rigor but informed by insider art-world experience'

MARI-CLAUDIA JIMÉNEZ, PARTNER, WITHERS ART AND ADVISORY

We have assembled a team of attorneys with a deep insider understanding of the art market, the art and objects that form its basis, and the historical context that surrounds it, all of which give us a singular perspective to counsel and advise our clients as they navigate the market. The practice is led by Mari-Claudia Jiménez, a former Chairman and President of Sotheby’s auction house, and one of the market’s most trusted lawyers and dealmakers.

Mari-Claudia is joined at 'Withers Art and Advisory' by Frank Lord, a lawyer and Art Historian with a PhD in art history. That background gives him a uniquely nuanced view of the legal issues clients face, as he speaks their language and shares their devotion to the works of art that are at the core of what we do. Mari-Claudia and Frank began their legal careers together in the art law group of Herrick, Feinstein LLP, where they worked on many high-profile, record-breaking transactions. After a decade apart, they are joining forces again to bring their unparalleled perspectives and expertise to 'Withers Art and Advisory'.

'Unlike other lawyers in the field, we are as comfortable talking about art history and the market as we are in resolving the myriad legal issues that come up when art is traded'

FRANK K. LORD IV, PHD, SENIOR COUNSEL, WITHERS ART AND ADVISORY

Subscribe to The Fiduciary Eye

Our seasonal newsletter will be published on our website twice per year. Subscribe to ensure you receive a copy direct to your inbox.

The market finds its footing and trophy lots come roaring back

Between us, we have participated in scores of auction seasons, but last week’s New York sales were among the most exciting and energetic in recent memory. Let’s review what happened and then dig into the stories behind the headlines. In just five days, more than $2.1b of art changed hands at Christie’s and Sotheby’s, the city’s two major auction houses forever caught in a back-and-forth battle for supremacy; in addition, Phillips took in $92m.

After three consecutive seasons of sharply declining sales – an eternity in the art world – this November brought an exceptional bounty of masterpieces from the estates of several storied collectors, including mega-philanthropist and cosmetics titan Leonard Lauder, Hyatt Hotels founder Jay Pritzker and his wife Cindy, and Atlantic Records impresario Nesuhi Ertegun, along with a treasure trove of Modern gems amassed by a little-known couple from Pennsylvania, the Weises, who founded a regional supermarket chain.

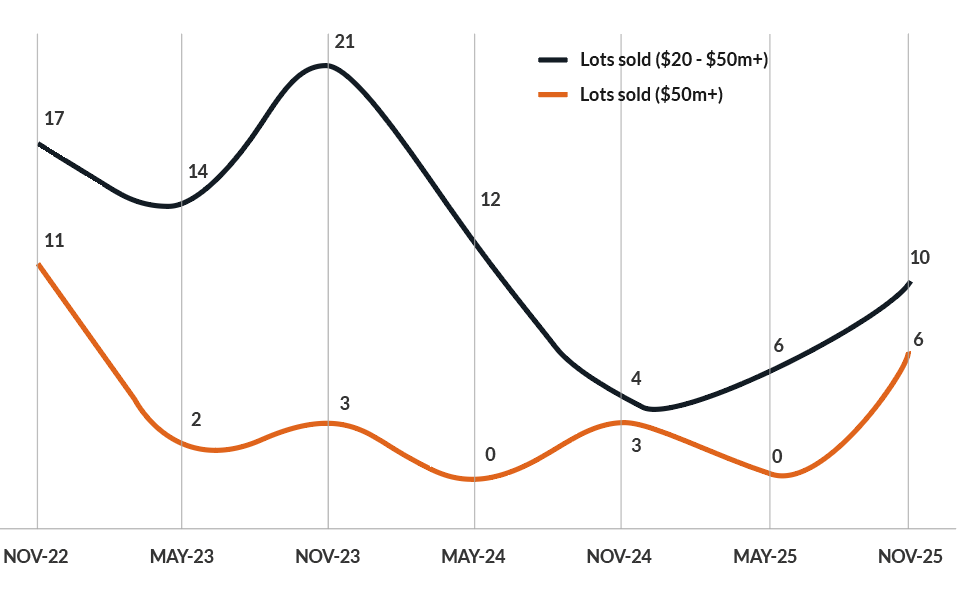

Those four estates warranted stand-alone auctions, but the season also boasted valuable property from several other major estate collections, including those of Ambassador Arnold and Joan Saltzman, Las Vegas casino executive Elaine Wynn, and high-profile philanthropist Stefan Edlis (who is survived by his wife Gael Neeson), as well a tranche of masterpieces from the Kawamura Memorial DIC Museum of Art in Japan. Buyers met the opportunity with gusto: 16 artworks sold above $20m, of which six went for more than $50m, and a showstopping portrait by Gustav Klimt flew past the $200m mark. By comparison, in last May’s round of New York marquee sales, just six lots passed $20m and none sold for more than $50m.

Christie's kicked off the season with their large two-part sale: the previously little-known collection of Robert F. and Patricia G. Ross Weis followed by a 20th century art sale with a healthy 61 lots. Bidding was brisk and the energy in the room demonstrated a change of sentiment going into the season. Totaling $678m, the evening was led by a striking orange and red Mark Rothko from 1958, which made $62.2m, followed by Picasso's 1932 portrait of Marie-Thérèse Walter and Monet's Nymphéas, each of which brought $45.5m.

Although Christie's has dominated the market for several seasons, this fall Sotheby’s edged them out, having landed three of the major collections coming to market, including the much-coveted Lauder estate. As a direct result, they sold the top four lots by value. It was an auspicious start to the auction house’s new flagship in the landmark Marcel Breuer building at Madison Avenue and 75th Street, formerly home to the Whitney Museum of American Art. Leonard Lauder was the longtime Chairman of the Whitney’s Board, so there was special resonance in having his collection displayed there as part of Sotheby’s pre-sale exhibition and making the Evening Sale of his work the opening auction in the company’s new headquarters.

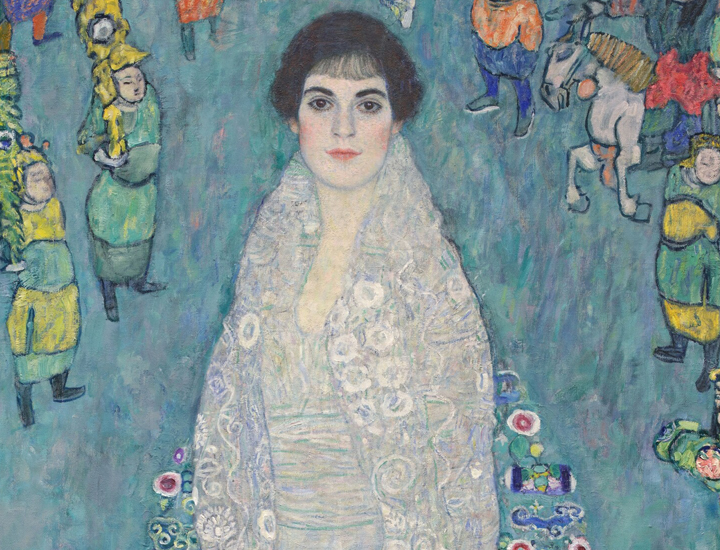

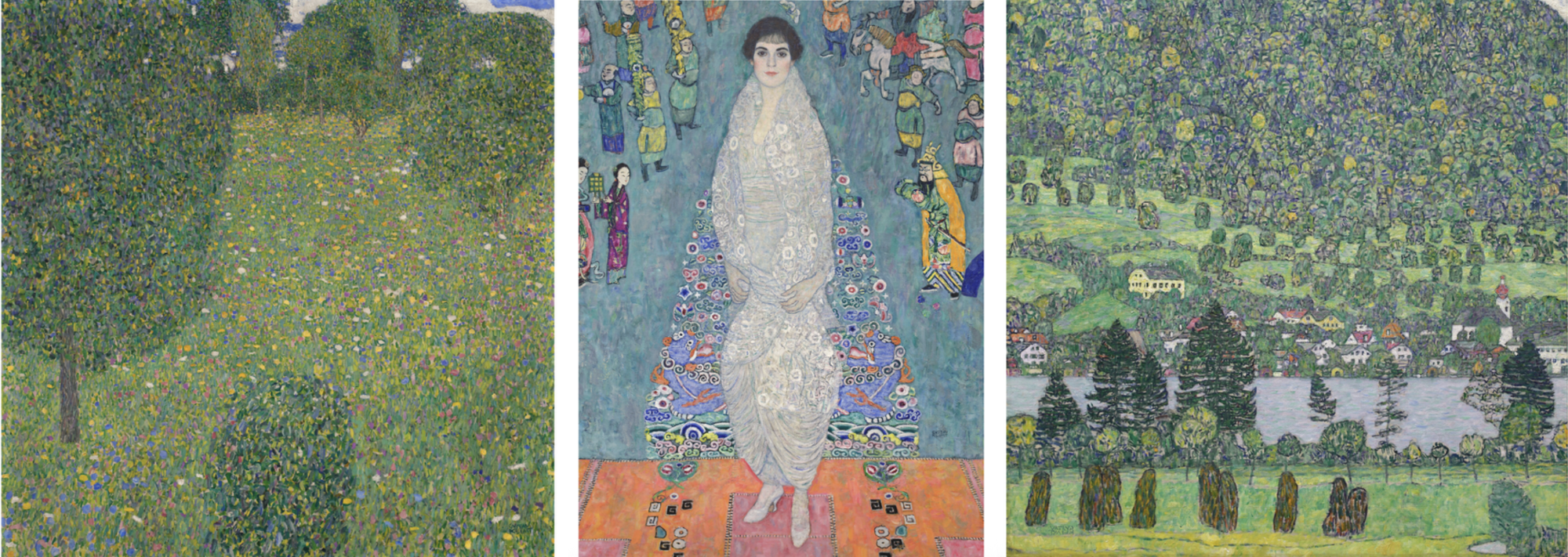

Auctions are famously unpredictable, but the stars were in alignment this time. When the centerpiece of Lauder’s collection, Gustav Klimt’s Portrait of Elisabeth Lederer – estimated at the stratospherically high price of $150m – came up, it attracted no less than six deep-pocketed bidders (almost unheard of at these price levels) and sold for a record $236.4m, the highest price paid for any Modern or Contemporary artwork at auction. (The only artwork ever to have hammered for more was Leonardo da Vinci’s Salvatore Mundi, the ultimate outlier, which brought $450.3m in 2017 at Christie’s.) Two other Klimt paintings owned by Lauder, both landscapes, sold for a combined $156.1m, and the Evening Sale realized a total of $527.5m. An hour later, Maurizio Cattelan’s gold toilet, America, found a buyer at $12.1m, demonstrating the extraordinary range in tastes among today’s top collectors.

We still don’t know who purchased the Klimt portrait (rumor has it that it went to the Middle East), but on Wednesday the buyer of the Cattelan was revealed to be Ripley’s Believe It or Not! The week closed on another record-breaking note when Frida Kahlo’s haunting self-portrait El sueño (La cama) brought $54.7m, the highest price ever realized at auction for a work by a female artist.

Auction house totals

Sotheby's | US$1.173b

Image: Courtesy Sotheby's

Christie's | US$965m

Image: Courtesy Christie's

Phillips | US$92m

Image: Courtesy Phillips

This was a remarkable turnaround for an art market that had been suffering for an uncomfortably long period from a lack of supply at the highest end. But after three lackluster seasons, the often-quoted cliché of the 'three D’s' – death, debt, and divorce – that have always powered the auction market proved once again to be true. The estates of leading collectors brought forth an abundance of fresh-to-market, best-in-class property, inspiring buyers to return with pent-up enthusiasm. The week demonstrated the unique power of auctions to surpass expectations and to reward shrewd sellers who understand how to get the best out of their chosen auction houses.

Summary of evening sale results

For full results, including day sales, click the button below:

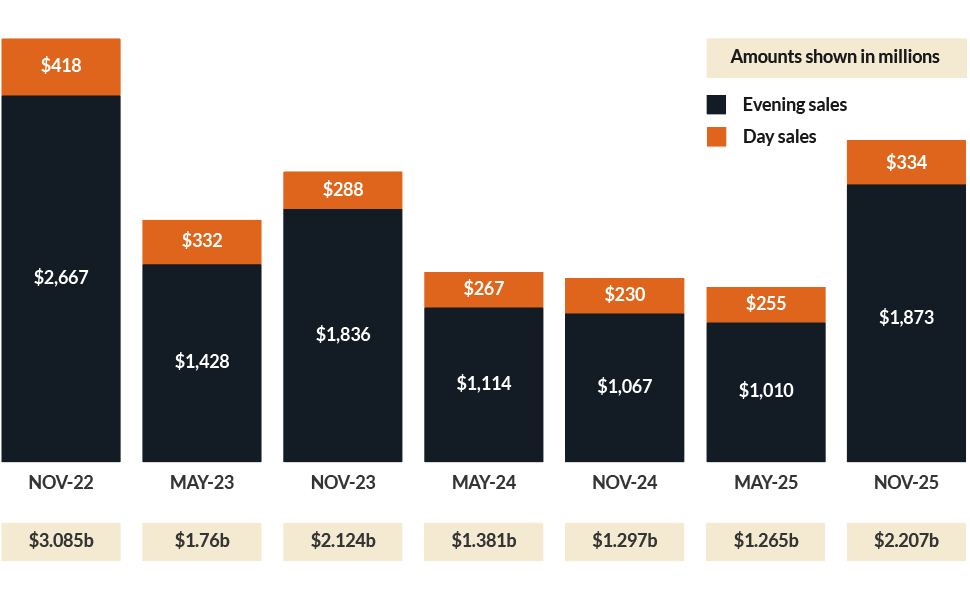

To put the results of the week in context, we asked ArtTactic, the London-based art data aggregator, to give us a snapshot of the last seven seasons of New York marquee auctions. Back in November 2022, the art market reached its last peak, thanks to the $1.6b auction of the Paul Allen collection at Christie’s. The overall market maintained strength through 2023, then the top tier dropped precipitously for three successive seasons: the number of lots selling above $20m fell by 50% in May 2024, and another 50% the following November.

Consolidated sales, New York Marquee Auctions (Christie's, Phillips, Sotheby's)

Trophy Lots Sold, November 2022-November 2025

Key fiduciary issues (or what keeps us up at night)

The sudden reappearance of so many high-quality, high-value artworks was exciting. But going into this season, our biggest concern was whether the market could absorb a sudden surge in 'trophy' lots, especially during a period of high-interest rates and political volatility. We were also conscious that this season was heavily weighted toward art made in the early 20th century, with many fewer ultra-high-value contemporary works. There has been much discussion about changes in taste as Gen Xers surpass Baby Boomers as the greatest force in the market and Millennials start to flex their muscles, so it was surprising to see the contemporary sector remaining fairly muted, apart from Cattelan and stand-out paintings by Jean-Michel Basquiat and Christopher Wool.

This season Christie's and Sotheby's doubled down on what they do best, which is creating a compelling story about collectors: weaving a narrative around a major collection is the key to its success at auction. In today’s market, how a collection is marketed is just as important as how it is estimated. The auction houses do a brilliant job telling the stories of collectors in every medium: glossy catalogues (this year they spared no expense, even publishing hardcover clothbound versions for the most elite collection sales), marketing videos, highly curated exhibition installations, and a continual stream of digital content and social media posts, all orchestrated to capture the ethos of the collector and the way they lived with and assembled their works. It’s one of the many reasons estates often choose auction over private sales.

Still, apart from the records achieved this season, many of the top works sold on single bids to third-party guarantors – meaning they were effectively presold. This raises the question of whether many of the estimates were too high to attract a healthy number of bidders, and whether some of the works that came to auction might have done better if sold privately or held back for another season or more. These are precisely the questions that we must weigh carefully with our clients when negotiating with auction houses. The competition between Christie’s and Sotheby’s for major estates has become increasingly fierce, putting sellers in a strong position to demand high guarantees or greater shares of the buyer’s premium; but this often results in the auction houses pushing their estimates too high and stifling competition. A careful balance is key to optimizing the ultimate results.

Three paintings by Gustav Klimt from the Leonard Lauder collection came to market simultaneously, raising an issue about 'blockage.' From left to right: Blooming Meadow (1908), Portrait of Elisabeth Lederer (1914-16), and Forest Slope in Unterach on the Attersee (1916).

Perhaps the most fascinating issue raised this week was what happens when a number of high-value works by the same artist with a somewhat limited buyer pool come to the market at once. As fiduciaries, we are used to seeing this concept play out in the context of a valuation as a 'blockage discount' — which is when a discount is applied to the value of a group of similar artworks by the same artist because selling them at once would likely depress the market value compared to selling them individually over time.

In a sale context, auction houses often try to avoid this, by selling the works over multiple seasons and locations, or by offering some works privately. This reflects the market reality of supply and demand, where a glut of similar items reduces the price each one can command, even if the individual works are highly desirable. Using this logic, we were somewhat surprised that Sotheby’s offered all three of the Lauder Klimts in the same sale.

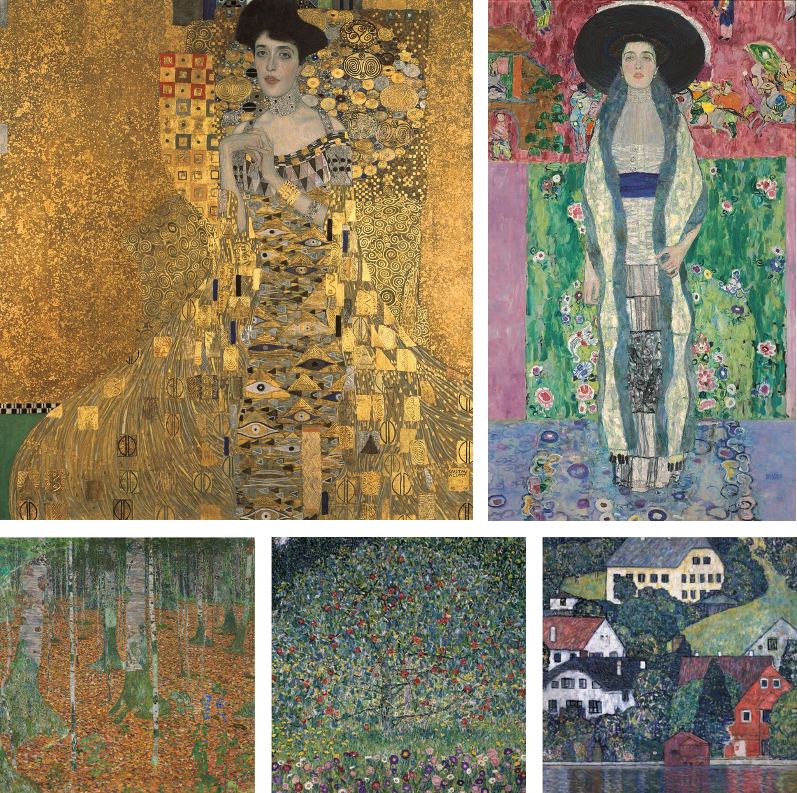

Obviously, the portrait was a remarkable success, but neither of the landscapes took off, and one even hammered slightly under its estimate. We don’t know what alternative strategies were considered, but it’s instructive to look back to 2006, when Christie’s was entrusted with four Klimts that had been restituted by Austria to the heirs of Adele and Ferdinand Bloch-Bauer. (The amazing story behind the restitution was told in the 2015 film Woman in Gold starring Helen Mirren.) In that case, the sellers chose to offer the spectacular Portrait of Adele Bloch-Bauer I privately, and it ultimately was bought by Ronald Lauder, Leonard’s brother, for the then-record price of $135m and gifted to the Neue Galerie in New York in June 2006. (Mari-Claudia represented the Neue Galerie in that transaction.)

A second portrait of Adele came to auction in November 2006 along with three Klimt landscapes, creating a very similar situation to the Leonard Lauder sale. Portrait of Adele Bloch-Bauer II sold for $88m (the buyer was Oprah Winfrey, who later reportedly sold it privately for $150m), while the landscapes were offered with relatively low estimates, ranging from $15m to $18m; they did very well, with two selling above $30m, and one bringing $40m. No doubt Sotheby’s looked back at the Christie’s sale to inform their strategy but, given the post-sale speculation that the landscapes could have drawn more attention and garnered significantly higher prices if they had been separated from the portrait, there are likely to be more conversations about how to address the 'blockage' issue going forward.

A similar blockage issue, also concerning a group of Klimt paintings, came up in 2006 when they were offered at Christies. Top: Portrait of Adele Bloch-Bauer I (1907) and Portrait of Adele Bloch-Bauer II (1912). Bottom: Birch Forest (1903), Apple Tree I (1912), and Houses at Unterach on the Attersee (ca. 1916).

Maurizio Cattelan’s America (2016). Courtesy Sotheby's.

An unusual bidding strategy was employed for an equally unusual lot, Maurizio Cattelan’s America. Bidding began at a steep $10m, which was quite literally the value of the toilet’s weight in gold. The strategy, which protected the sculpture's material value, did not bring competing bidders, and the much-publicized lot – and subject of countless selfies – went to Ripley’s on a single bid. With fees, the final price came to $12.1m, or 20% above the value of the gold.

By comparison, last year when Sotheby's sold Cattelan’s Comedian, a banana duct-taped to the wall, with an estimate untethered to material value, the $6.2m paid by the buyer was more than 24 million times the cost of the banana, which had been purchased at the fruit stand in front of the auction house for 25 cents. Both works raise big questions for the viewer: Is this a joke? (And if so, are you in on it?) Who is the Comedian? What is America? Viewed in terms of material cost to sale price, the former was a huge success for Sotheby’s and the latter was not. Do these very different results speak to the works’ relative art historical significance, or do they just tell us which of Sotheby's marketing approaches was more effective?

At 'Withers Art and Advisory' we’ll be unpacking the results from these wide-ranging sales from every possible angle and putting these insights to work as we counsel our clients. For clients preparing to sell or strategizing around legacy planning, this season underscored why rigorous due diligence, careful positioning, and timing matter. In an environment where not just quality but thoughtful strategy drive outcomes, the right advice can make all the difference.

How we can help

Authors

Mari-Claudia Jiménez

Partner | Co-head of art law | Withers Art and Advisory | New York

Mari-Claudia Jiménez

Partner | Co-head of art law | Withers Art and Advisory | New York

Withers Art and Advisory

View Profile

Frank K. Lord IV

Senior Counsel | Withers Art and Advisory | New York

Frank K. Lord IV

Senior Counsel | Withers Art and Advisory | New York

Withers Art and Advisory

View ProfileGet in touch

If you would like to talk to us for more information, please call us and we will be happy to assist.